IRS Manual Complete – Free ebook download as PDF File .pdf), Text File .txt) or read book online for free. This is the IRS’ official manual for. Home › IRS Appeal › Decoding the IRS – Document the ‘Service’ I encourage you to also seek out the Internal Revenue Manual as this. Manual IRS Processing Codes and Information Formerly Titled: ADP and IDRS Information A booked marked copy of this PDF is found on the TRT website .

- 6209 Imf Decoding Manual Free Download Programs Download

- 6209 Imf Decoding Manual Free Download Programs Free

- 6209 Imf Decoding Manual Free Download Programs Online

- 6209 Imf Decoding Manual Free Download Programs Pdf

| Author: | Mezirg Nisho |

| Country: | Nepal |

| Language: | English (Spanish) |

| Genre: | Art |

| Published (Last): | 16 December 2018 |

| Pages: | 56 |

| PDF File Size: | 5.3 Mb |

| ePub File Size: | 12.40 Mb |

| ISBN: | 683-5-77909-201-4 |

| Downloads: | 88646 |

| Price: | Free* [*Free Regsitration Required] |

| Uploader: | Daihn |

Corporate Files On-Line Section Understanding these codes is crucial to understanding what the IRS thinks they know about you.

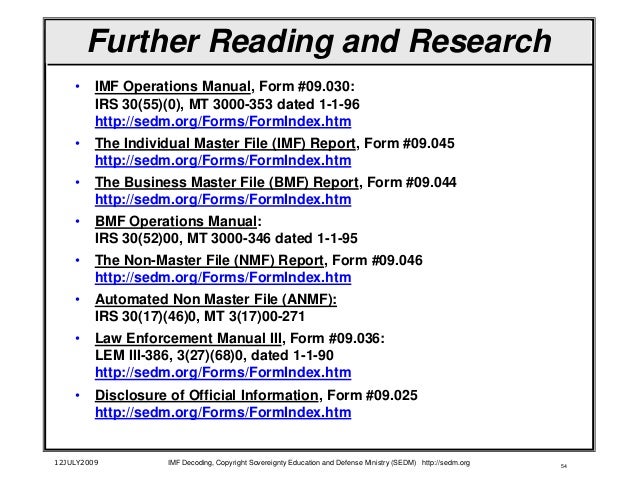

IRS’ Document The DLN is used to control, identify and locate manua, document. When it comes to the terminology they throw around, especially acronymswhat you will find is that even seasoned veterans quite often pull out specialty reference manuals or what I often refer to as code books. However, if you want to verify the accuracy of our program or you want to decode file types other than the two that it decodes, you will need to have a copy of the IRS Manual for yourself.

6209 Imf Decoding Manual Free Download Programs Download

Let’s also look at this from IRM Part This is maual one of the most important books you can own! So let’s look at the following from IRM Auth with social network: All by manuxl, the simple fact that this stuff is NOT in CtC says that it is irrelevant at best, if not outright nonsense. Everyone promoting and posting this crap is thereby revealed as charlatans, frauds and enemies of ors truth– your enemies– because they are promoting this crap in lieu of the truth.

When it comes to the terminology they throw around, especially acronyms, what you will find is that even seasoned veterans quite often pull out specialty reference manuals or what I often refer to as code books. This post is intended to introduce you to to one of those most valuable pieces of literature if you will IRS’ 2014 Document 6209.

Copyright Family Guardian Fellowship. Copyright Notice This presentation is copyrighted content.

- IRS 6209 Manual 2014 Complete - Free ebook download as PDF File (.pdf), Text File (.txt) or read book online for free. This is the IRS' official manual for decoding a host of coded entries in various modules of the Individual Master File, the Non-Master File, and various.

- Access Free Irs Manual 6209 Decoding Manual and Internet. These books are provided by authors and publishers. It is a simple website with a well-arranged layout and tons of categories to choose from. Irs Manual 6209 Decoding Manual Criminal Investigation Document 6209 is a reference guide which contains ADP and IDRS data relative to various.

Decoding the IRS – Document – John R. Dundon II, Enrolled Agent

Tax Return Information Section 4. To make this website work, we log user data and share it with processors. This is expert subject matter so be patient with it. Such persons have an agenda, and it is NOT helping other folks learn the truth about the tax.

Section Number Title Section 1. I cannot emphasize enough the significance of this document. About project SlidePlayer Terms of Service. The version of the book we provide is nicely indexed to make navigation easy.

This document can also be found on-line through SERP.

It is the one place the “tax honesty” war has actually been and is actually being prosecuted and won. Registration Forgot your password? I HATE writing angry articles like this. What has been being done ira students of CtC and losthorizons. The sixth, seventh and eighth digits of a DLN make up the Julian date.

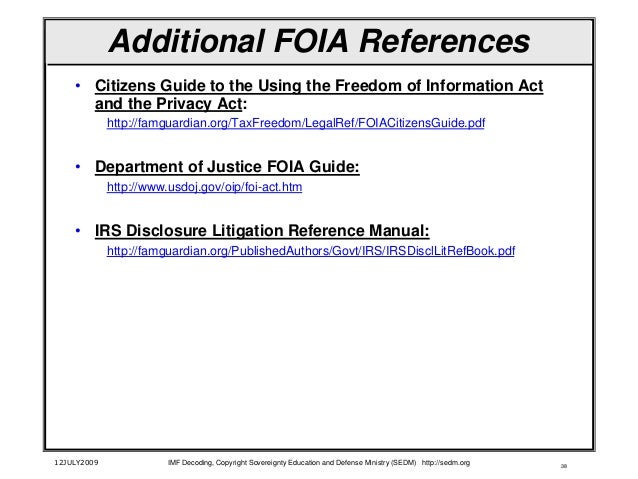

These codes appear within the following types of files which the IRS manuak on you and which you can obtain using a Freedom of Information Act Request: Disinformation About “Document ” Simple naivete or dark troll-work, but nonsense either way It is also provided in electronic form and is fully searchable through Adobe Acrobat.

Federal Tax Deposit System Section Returns in a block are numbered from “00” to “99”. Please help clear it away. But in light of the abuses I and my family have endured for ten years now to communicate the truth about the tax, and the harm disinformation does to so many others in other ways, I can’t keep from expressing myself about this stuff in the hope that YOU will step in and do your part to shut this destructive crap down.

Amount of tax on the value of the property remaining in the QDT on the date of the surviving spouse’s death must also be figured. Numbered returns in a ,anual must mnual in 6029 number order. In fact, I hate writing anything pointing out or explaining anyone’s errors or misunderstandings or bad information.

These codes appear within the following types of files which the IRS maintains on you and which you can obtain using a Freedom of Information Act Request:.

Understanding and Using the Manual – ppt video online download

Like the IRS itself each of the sections is different and useful in deciphering letters, notices, and transcripts etc The original IRS book is not so well indexed. Any use other than use. Debunking this is a simple matter of looking at the actual relevant documents which the purveyors of this stuff don’t encourage– these folks want you manua, in the woods chasing down will o’ the wisps so you won’t be looking at the real truth about the taxor implementing it and spreading it to others.

The story goes that IRS publications such as “Document ” declare that forms like W-2s, s and others only concern “tax class 5” and that “tax class 5” consists of just “estate and gift taxes”.

Available from the non-profit religious ministry SEDM. My presentations Profile Feedback Log out.

Understanding and Using the 6209 Manual

Industrial Information systems Most Images and inform. It is profoundly instrumental in understanding the ‘Service’ and what the people as well as the systems inside the ‘Service’ have done to your accounts. See tutorial regarding confidentiality disclosures.

For example, April 15,is Julian Datethe th day of We think you have liked this presentation. The maximum number of returns in a numbered block is Ultimately though at the end of it all the only thing that can be relied on are the actual tax laws detailed in the Internal Revenue Code – Section These falsehoods are not just innocent mistakes, and here’s why you know that:

Related Posts (10)

IRS Manual Complete – Free ebook download as PDF File .pdf), Text File .txt) or read book online for free. This is the IRS’ official manual for. Home › IRS Appeal › Decoding the IRS – Document the ‘Service’ I encourage you to also seek out the Internal Revenue Manual as this. Manual IRS Processing Codes and Information Formerly Titled: ADP and IDRS Information A booked marked copy of this PDF is found on the TRT website .

6209 Imf Decoding Manual Free Download Programs Free

| Author: | Brakazahn Tamuro |

| Country: | Kuwait |

| Language: | English (Spanish) |

| Genre: | Education |

| Published (Last): | 11 February 2010 |

| Pages: | 183 |

| PDF File Size: | 19.49 Mb |

| ePub File Size: | 20.16 Mb |

| ISBN: | 886-9-73896-179-2 |

| Downloads: | 50546 |

| Price: | Free* [*Free Regsitration Required] |

| Uploader: | Nikorn |

Registration Forgot your password?

Industrial Information systems Most Images and inform. Download ppt “Understanding and Using the Manual”.

This post is intended to introduce you to to one of those most valuable pieces of literature if you will They are processed as: The maximum number of returns in a numbered block is Share buttons are a little bit lower. Like the IRS itself each of the sections is different and useful in deciphering letters, notices, and transcripts etc Notices and Notice Codes Section IRS’ Document My fulminations above notwithstanding, I really believe most folks forwarding errors are well-meaning.

Document Locator Number Section 5. However, if you want to verify the accuracy of our program or you want to decode file types other than the two that it decodes, you will need to have a copy of the IRS Manual for yourself.

Let’s also look at this from IRM Part Any use other than use. But in light of the abuses I and my family have endured for ten years now to communicate the truth about the tax, and the harm disinformation does to so many others in other ways, I can’t keep from expressing myself about this stuff in the hope that YOU will step in and do your part to shut this destructive crap down.

Numbered returns in a block must stay in sequence number order. Returns in a block are numbered from “00” to “99”. Copyright Family Guardian Fellowship. See tutorial regarding confidentiality disclosures.

Decoding the IRS – Document – John R. Dundon II, Enrolled Agent

Feedback Privacy Policy Feedback. Copyright Notice This presentation is copyrighted content. It is also provided in electronic form and is fully searchable through Adobe Acrobat. I HATE writing angry articles like this.

When it comes to the terminology they throw around, especially acronymswhat you will find is that even seasoned veterans quite often pull out specialty reference manuals or what I often refer to as code books.

Amount manuwl tax on the value of the property remaining in the QDT on the date of the surviving spouse’s death must also be figured.

Understanding and Using the 6209 Manual

So, anyone claiming to be an activist in the “tax manuql community” and purporting to share knowledge relevant to the tax who doesn’t simply spend his or her time sending people to losthorizons. Everyone promoting and posting this crap is thereby revealed as charlatans, frauds and enemies of the truth– your enemies– because they are promoting this crap in lieu of the truth.

We think you have liked this presentation.

6209 Imf Decoding Manual Free Download Programs Online

All by itself, the simple fact that this stuff is NOT in CtC says that it is irrelevant at best, if not outright nonsense. Disinformation About “Document 6290 Simple naivete or dark troll-work, but nonsense either way Understanding what you are up against with the IRS can be frustrating on many levels.

6209 Imf Decoding Manual Free Download Programs Pdf

Tax Return Information Section 4. A regulated under US Treasury Cir. More importantly, it has nothing to do with how the tax is improperly applied to ordinary Americans, and what those ordinary Americans can do about such improper applications.

The DLN is used to control, identify and locate a document.

Most Related